Guest Post by Phil Helwig, P. Eng.

in reaction to Danny William’s speech to the Board of Trade but never completed

it.

Muskrat Falls will be scrutinized. It is timely to examine some issues for the

investigation.

The mandate of NL Hydro / Nalcor is to provide

power to the citizens of the Province at the lowest possible cost. Early in my

career I worked in the Systems Planning Group of Shawinigan Engineering under

the direction of George Scruton who was an engineer of impeccable integrity.

Most of our work involved system expansion studies. George insisted as a

fundamental principle that the cost of

all the options – capital, fuel, operation and maintenance and related financial

costs be developed to similar standards of accuracy and that competing options

be equivalent in terms of reliability. In the case of Muskrat Falls I

believe that the probability of bias was high given the big disparity between the

efforts and resources devoted to the comparisons between the Isolated Island

Option and Muskrat Falls: perhaps $ 3 million, for the Isolated Island Option

versus $420 million for Muskrat Falls. Additionally the documents I have seen show

little evidence that optimization of the Isolated Island System was ever seriously

attempted. The lowest cost power would certainly have been obtained by

completing Phase 3 of the Bay des Espoir Development (75 MW) that could have

produced power at a low enough cost to allow a reduction in power rates!! Terra Nova Development with a capacity of 144

MW would also be interesting; as well as the addition of a third unit at Cat

Arm which already incorporates provisions for a one unit expansion. But none of

these projects were ever considered, as far as I can tell. I was never

convinced that Muskrat Falls was truly the lowest cost alternative.

2.

Danny Williams argued that cost over-runs were

usual with large mega projects and were to be expected. As an engineer I

challenge this assumption. It is interesting to compare related experience:

notably Churchill Falls Development, one of the largest private sector

developments at the time, which was completed ahead of schedule and under

budget. More recently, experience on the James Bay Complex in Quebec was

positive: Phase 1 of the Complex was completed 4% under budget while the

individual projects of Phase 2 range from “on budget” to 3.2% under budget for

the five projects in Phase 2. What can explain the difference between these

projects and Muskrat Falls? I think that there are a couple of reasons that

could (at least in part) explain the different experiences:

impact of three mega projects under construction at the same time, with Muskrat

Falls the being last of the three, following Vale Smelter and Hebron, does not

seem to have been addressed by Nalcor in their presentation to the Reference to

the PUB in 2012. Neither Nalcor, PUB

officials or any of the intervenors seem to have noticed this elephant in the

room. However, contractors were well aware of the problem. I believe the

cost impact of failing to account for this situation could have added 25% – 30%

to the Project cost.

_________________________________________________

Also by Phil Helwig:

How Reliable Will Muskrat Power Be?

__________________________________________________

believe that Hydro Quebec’s estimating procedures, following guidelines of the

Quebec Association of Consulting Engineers, were much more rigorous than

applied by Nalcor. These procedures involved preparation of a Detailed Project

Definition (Avant-project détaillé) report typically, described as a “bankable”

report. Also on very large projects a Control Estimate was usually prepared. This was my impression from working on two

Hydro Quebec projects with a major Quebec engineering firm in Montreal. I

also think that Hydro Quebec cost estimators are very experienced and

competent. However, these two points cannot explain the magnitudes of the cost

over-run at Muskrat Falls. Is Nalcor’s limited experience in the project

management of mega projects to blame? See below:

The first issue concerns Nalcor’s experience in

project management of very large projects, which is nil. Originally, the

project management phase was included in SNC-Lavalin’s scope of work. I

understand that Nalcor felt it could realise significant savings by taking over

this facet of the work themselves. I do not know whether SNC-Lavalin had any

further involvement in project management. Nalcor appears to have assumed

responsibility for this role and their performance or deficiencies need to be

assessed. Remarks from a senior SNC-Lavalin engineer concern two Nalcor

practices that were judged to be unproductive as below:

The practice of appointing individuals from NL

Hydro or sub-consultants to track / oversee certain components of design or

planning was often counterproductive as these individuals often did not have

the necessary experience or training to contribute to design preparation and whose

contributions were limited and sometimes negative. Did this decision also

compromise efficiency?

My confidant also feared that Nalcor would not

be tough enough in evaluating claims for “extras”.

Did the decision to carry out most of the design

work in St. John’s deprive the project of the most experienced and capable of

SNC-Lavalin’s staff?

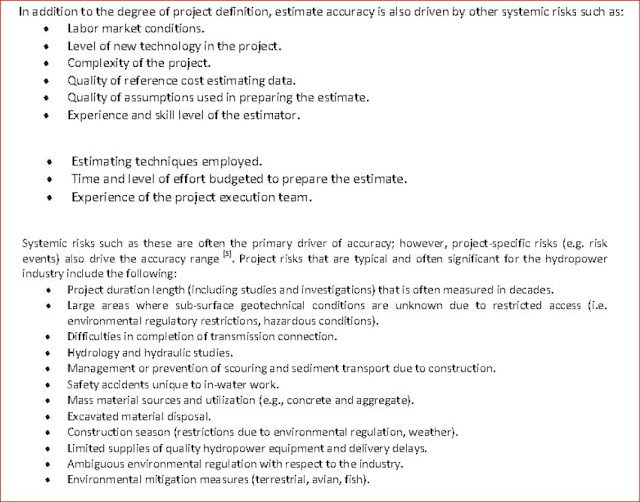

It is noted that Nalcor use AACE Guidelines for

preparation of their capita cost estimates. These guidelines note that simply

following Guideline procedures will not guarantee a quality estimate but that

the quality of the estimate ultimately depends on the accuracy of the inputs.

The following lists elaborate:

assess market conditions appropriately. Were they equally, inattentive in

considering the rest of these criteria?

investigate the points I have raised above.

Helwig, P.Eng

education (8 years) and in design and technical management (44 years). Most of

his formative experience was with a small company in Newfoundland (ShawMont)

which valued versatility, as a result Phil was able to develop expertize that

goes well beyond the skills set normally associated with his formal area of

competence, as a hydrotechnical specialist. His main area of expertise is in

the fields of hydropower and water resources where he has been involved in

investigations, economic planning and project optimization studies and detailed

design. He has been responsible for several innovations in Canadian practice:

notably, the design of Cat Arm Hydel unlined pressure tunnel (head = 386 m) and

“bathtub overflow spillway” and design of Hinds Lake Power Canal based on

natural armouring (the first application of this technology in hydro design

worldwide) and the design of Paradise River double curvature arch dam only the

third arch dam ever built in Canada. More recently from his experience in South

Asia he has developed expertize in design of hydraulic structures to handle

water borne sediment. His latest interest is in the field of eco-hydraulics. In

2004 Phil formed his own company, Helwig Hydrotechnique Ltd. and has worked on

four continents in three languages.

Technology transfer is an integral part of all Phil Helwig’s assignments.

We all know that Nalcor mismanaged the Muskrat Falls project to a point where it has become a serious financial liability around our necks. The question is whether cost overruns where deliberately ignored to ensure the project was completed regardless of the consequences. Danny Williams was like most politicians in NL. All of them favour large short term mega projects to create high paying short term jobs for political reasons. Phil Helwig has stated in 2 a. that "The impact of three mega projects under construction at the same time, with Muskrat Falls being last of the three, following Vale Smelter and Hebron, does not seem to have been addressed by Nalcor in their presentation to the Reference to the PUB in 2012." What he fails to mention is that all three projects are nothing more than giant make work projects. Long Harbour forgo royalties from the mine side in exchange for a processing plant, the capital costs of Hebron was paid for by forgoing future royalties of upwards to $10 Billion and Muskrat Falls was nothing more than a continuation of the province foregoing financial stability in exchange for short term construction projects. It is this aspect of the Muskrat Falls folly that will never be addressed. How Mega Projects are financed either through future royalties or through future payments on debt is the question that needs to be answered. Right away the inquiry has failed be fore it has started.

Yes, agree with you on muskrat, but on the other two projects, understand what you are saying. But the difference is, muskrat is all public money, the other two projects is private money, except for our 5 percent in Hebron, so leave that for a now. So guess your other solution is leave the oil and minerals in the ground, hence, no make work project, no spending in the province of some, oh, I don't know, maybe 5 or 10 billion. Lots of guys and girls made a living, a good living in the last ten years on this private money, or make work as you call it. The other option would have been, no work, go elsewhere, or welfare for those skilled workers here in this province. Or what would be your solution or action, if you were in charge.

With Hebron-a floating production platform would have produced full royalties within about two years vs 10 to 13 for GBS. Long Harbour-it may or may not have been better to ship the ore out raw and collect more royalties but personally I don't think the operation is going to be there when VB mine runs out of ore.

Whose decision to build Hebron Gbs or floating??? If it was our goverments, then I agree with you. If it was the oil companies, guess it was required, and I would let the experts, the oil people decide. They know the business..so unless you are an expert too… And not just an armchair expert (maybe) then you should have been screaming blue murder, and putting forward your technical reasons why a floating platform, and showing spreadsheets of how better to be shipping ore out raw.

With Hebron, the total costs of the project was $14.5 Billion when completed. These capital costs had to be repaid before any royalties are accrued but the construction jobs are long gone. When the Hebron GBS was launched the price of oil was at about $54 per barrel and it would have taken approximately 13 years before any royalties were paid out. The oil companies came out ahead regardless of which system was used so it was basically a win win situation for them anyways. The other aspect that the field will be about half gone before we receive any royalties but with a floating system royalties would have been collected after about two years but it would have meant being built in South Korea like the Terra Nova field FPS. I stand by what I said in that the two GBS projects were built solely for the purpose of creating short term construction jobs and other than Norway, I challenge anyone to find another area of the world where such a massive sum of royalties was exchanged for short term construction jobs and contracts. We must not forget in 1996 when John Crosbie had to go begging to Ottawa to bail out the original Hibernia GBS. We gave up substantial amounts of royalties that time also. Like the inshore fishermen of decades ago, the construction industry has become the new untouchables in our province. A sort of to big to fail circle that we have gotten ourselves into. I am just wondering what the next Mega Project is going to be. A tunnel across the straits maybe?

1st principles allow us to simply the problem, the over runs and mismanagement always lead back to a couple basic reasons (no matter what DW or others say):

1) change in scope

2) change in conditions

3) inexperienced contractor

4) ‘broken’ bidding (read as ‘scorched earth’, closed or other bidding process that could be inferred as limited) combined with owner inexperience

For MF, #1 and #2 don’t apply as were previously inplace, unchanged and set before bidding (should be read as effectively since some changes always occur), #3 applies only if owner makes a mistake either in the bidding process or during the work by letting contractor off the hook, so we are left with #4 as the 2 items are deliberately combined as they are dependent. When we discuss inexperience of the owner we also must include political interference as they are synonymous when dealing with publically funded works; also I have deliberately included illegal activities under inexperienced owner since it is the owners/funders responsibility to curtail.

I have always questioned the statement that 'having several projects ongoing simultaneously affects the bid price'. There are arguments for and against as projects such as these pieces of work are typically governed under a negotiated major trades agreement (ie the labour prices are for fixed and known before beginning work). Labour rates for MF are effectively the same in buildup as charged for Hebron, LH etc-I suspect the agreement is posted on RTDC website and the rates can be reviewed, I would say having this agreement provided stability during a longer term piece of work.

I do see local contractors in their bidding taking advantage of this statement for work not covered under specific labour contracts-but for MF the majority of work was completed by outside companies that are not affected by a Newfoundland labour shortage and a trade agreement was enacted, so I even see that as hard to believe. I would dispute this with Phil, but otherwise I would say he is onpoint as usual–> and I would agree that MF was the 'only' option considered for whatever reason.

PENG2

Peng2, locally Cahill boasts of their 150 million I think they did on MF, and I guess Pennecon had huge contracts. Cahill was a promoter of MF.

And as to contractor inexperience…..there was the issue of an Italian company as General, with no experience in the North like Labrador. And what of the dome, a 100 million waste, and the concrete collapse.

And you say #3 , contractor inexperience is not a factor?

And what of the cause of the flood at Mud Lake…..contractor/ Nalcor……or act of god? Oh….and the leaking cofferdam?

PF

PF:

I guess you missed that I said contractor inexperience applies only if owner makes a mistake-the owner wholly owns the responsibility for accepting the contractor. Means/methods are the contractors prevue, poor work are the owners responsibility if the owner accepted—so the issues you note need to be separated and analyzed individually.

So we are all on the same page, $127M is 'only' 1% of the $12.7B total cost, so I would again say no NL company was a major contractor at MF—maybe big for Cahill etc, but small in considering the larger scope of the work.

PENG2

Phil mentions 2 island hydro projects that would total 219 MW plus Cat Arm, and Nalcor had estimates of just 78 MW of different hydro additions, but in all, approaching 350 MW of island hydro. That is what Holyrood is using on average in winter. There is some 600 MW potential demand reduction from customer efficiency. We could add some 200 MW of wind that is cost effective and would not make our grid unstable. In all about 1150 MW potential to displace on average 350MW of thermal power. All of this was very cost effective and could have kept rates stable, some measures of low cost hydro and efficiency would permit a lowering of rates, not impossible…….and we opt for a 12.7 billion boondoggle as least cost, needing rates of 23 cents or more.

The leader of the Phillipines advises his soldiers to shoot women rebels in the vagina. That guy, if dealing with Incompetence here would at least have some guys balls put in a vice ( UN human rights is making a case against the Phillipine leader). But at least when Ed Martin and company takes the hot seat before Leblanc, a good examination of these sleeveveens and scallywags should give a similar effect. That may be the only justice we get.

Winston Adams

A variable rate would have also helped. Lower rates in the 2:00am to 5:00 am as well as a tax on excess consumption say above 6000 Kw yearly consumption. All to late now.

If you check the daily winter peak loads you will see demand pick up about 300 MW from 4 to 8 am, as programmable thermostats bring on baseboard heaters and hot water use increases. If anything, the opposite, higher rates at peak demand times is prudent, I suggest, and lower rates at low peak demand. A tax on excess consumption, yes, but 6000 kw a year seems rather low, the average for small electric heated houses now about more than 15,000, and many using more than 30,000. A scaled rate above 10,000 might be good, the more you use the higher the tax. One way to get the rich, who can afford it, to help the poor, and create jobs for efficiency upgrades.

Winston

Mr. Helwig discusses the possibility of adding units to Bay D'Espoir (BDE) (which Hydro itself is now looking at in the form of 154 MW Unit 8), Cat Arm, and a new development at Terra Nova. BDE and Cat were built with space to add an additional unit at each facility but it was my understanding that these units would add little to no new firm capacity but would add energy as spill is reduced. These units would add no capacity in winter but actually make more sense with the Maritime Link in service as spill could be monetized and sold in the New England market. These new units would also be more efficient than the older units.

I had not looked at the Terra Nova Development before. I did find reference to it this morning in the Shawmont small hydro study completed for Hydro in 1986 (which was probably written by Mr. Helwig). Looks like two sites would be developed, one of which would be in the National Park, with a capacity factor of 62%. That's pretty good and is higher than Star Lake and Granite Canal which were eventually developed. I wonder did proximity to the National Park prevent the Terra Nova development from going ahead, or was it lack of capacity in winter when the grid would need it most, or both?

Short of simply installing new thermal capacity to replace Holyrood or build and muck up Muskrat Falls as Nalcor has done, an alternative may have been to build the Maritime Link and then expand small hydro and wind generation (onshore and/or offshore) on the island with some new thermal generation to backup/balance other generation. Transmission build up would also be needed to move power around the island as wind levels fluctuate. Even with the ML, we would not be able to eliminate the need for some thermal generation by adding renewables.

I'd love to be able to chat with Mr. Helwig some day as I daresay he is a treasure trove of knowledge on the development of our system here in NL.

Cheers,

PENG3

Of course,PENG2, you ignore the cost effectiveness and achieveable potential of demand reduction from customer efficiency measures. With these,(600MW potential , I suggest, and just part of this needed) we do need thermal backup, as you say, but very very little use, and approach not far from 100 percent renewable……do you disagree.

Winston

Good morning Winston, I didn't ignore DR, I just didn't consider it in this post. I do agree with you that some combination of improved insulating and, your favorite, heat pumps, etc would have helped reduce demand. Never mind replacing light bulbs, that's not the big deal it's made out to be.

I agree, we could approach 100% renewable with wind and small hydro, but I still maintain the need for the ML to provide a path for balancing. The alternative is to curtail excess generation which impacts the economics.

Of course detailed study would be needed for all of this.

PENG3

Right on Phil, flawed technology transfer, indeed!

When personalities are permitted to get in the way of of applied science, society and common sense get pushed aside.

Self evident truth; qualified utility engineers displaced by a few "cable guys" on a mega project yet! who really is behind the wheel of the autonomous vehicles? who is profiteering with gas pump manipulation in the Lower Mainland?

Omg…we need onshore/offshore wind, small hydro, thermal power, maratime link, anything else. , conservation, demand, different rates for different times, heat pumps, air and ground. That's the kind of thinking that got us muskrat, and now even the firm believers of muskrat, are now agreeing it was a dud. Yup…and all engineers… My rant…

Hi Rant Guy

Well no, not all but most of these would have prevented the boondoggle. The combination of alternatives were never studied because they would have been least cost, and kept rates stable.

Is 75 Mw of hydro small? Petty Hr I think is 14 MW . Nfld Power has a dozen that adds up to 100 Mw, and produce power at about 3 cent cost. Now the old one at Victoria, near Carbonear was 0.5MW , and is now shut down ……….that is small by todays standard.

Guess you like mega projects that turn to boondoggles……..but fear to give your name, right? At least I use a indicator.

PF

Omg PF, nope ray is not back. But I comment on this blog every day and sometimes half dozen times a day, sometimes as Joe blow. No don't think there is anything wrong with small hydro, especially if the rates are cheap as you indicated. But my point was, for the little bit of power we need, do we have to introduce so many variations, especially like the maratime link. The main point being made on the muskrat – Goose Bay a couple of postings ago. When you add big things, then it drives the rates up. But I try and add a little humor sometimes, like if you ask any 5 engineers the same question, you will get at least 6 different answers, or maybe more. And some of my best friends are engineers. Lol

Yes Joe Blow, it can be coonfusing; did we really need offshore wind, or the Maritime Link? Not likely, but if there , now try to justify it. Problem is all the various approaches should have been discussed by engineers and studied well before now, and as Phil says 3 million spent on looking at the Island Isolated and hundreds of millions to study MF and never got it right. And other things ignored or buried, and finally surfacing here saying there were better ways.

Some 800 MW of extra hydro on the island, when totalled is no small amount.

It should be criminal what has transpired.

WA

Good article indeed.

Another thing that should be noticed (read : more oil on the fire…) is the review of the proposals and selection of Astaldi as a contractor.

One proposal was for a price tag of about 1.7 Billion. I think the others were 1.9 and 1.5. Astaldi was 1.0… The sole fact that their price tag is so far from the other should be a red light. It is obvious they are missing something. They forgot about this, do not know about that, under-estimate and more… When you have such a gap, 3 propositions within 1.7 + or – 0.2 and one is -0.7, either 3 out of 4 are way off the target, or 3 are rights and only 1 is wrong.

When the 3 others are the ones with experience in hydro and the similar environments and the one who is off is from Italy where nothing close to Labrador exists, you should not need more to make your mind.

Just that was enough to guarantee that there will be major cost overrun, in the magnitude of at least 100%. Not only do they must increase the price tag up to whatever is the real value, they will have to pay more to fix their bads here and there.

So Yes, the problems were obvious and known. MF has never been realistic from a financial point of view, nor from a technical point of view. Its sole purpose was political. Did it achieved its goal ? One has to define this goal before saying if it was achieved or not. I am no politician, so I can not try to identify a political goal.

At the end, I doubt a political can justify such a mess, but clearly, some disagree with me because they chose to go after that political goal…

Hercules34:

Good point.

I would ask PF(and others for a comment on this) as a followup from #3 in my posting above-would you lay this at the contractor (who probably took advantage of owner during the bidding process) or a poorly equipped owners team?

PENG2

I was told by a worker that they had no drill bits, no suitable places to plug in for a power tool, that no one knew what they were doing, but white hats all over the place, Nalcor and the Italian contractor………little productivity. Special form work came and no one knew how to put it together .that sort of thing.

And allowing Cahill made 10 percent profit on 150 million, gives 15 million………why not promote MF as a good thing. 1 % of a boondoggle is not bad , Eh?

PF

Come to think of it, 15 million is almost 3 times as much as the Gravy Man , Ed Martin , the 6 million dollar man , walked away with!

So Peng2, statistics …..lies and damn lies they say, when you minimize the profit by saying only 1 percent….is that your game?

PF

PF:

Not sure why your are misquoting me(please reread above)-I never tried to minimize or make light of a 'only' $150M contract. I don't know the Cahill contract well-are they direct to Nalcor, subbed under Andritz as a line item, fixed rate, TM, is the value really $150M etc; these are the details that tend to make these discussion irrelevant.

What I said was that $127M was 1% of $12.7B and NL contractors werent major players at MF considering the scope of MF, maybe big for individual NL firms getting $100M work, but small there none the less. Even if we consider only the dam at ~$6.5B, $200M 'only' amounts to 3%-I believe the applicable phrase is "stepping over a dollar to pick up a penny"? My statement of NL companies not being major players at MF stands.

In any event, assuming there was $15M profit on Cahills contract, as a tax payer I am glad it went there(ie locally) instead of another foreign sub-contractor brought in by the foreign prime.

PENG2

Hi Peng2,

I definitely put that one on the owner of the project. Astaldi surely did their best to estimate the project. Also, they surely not had access to everyone else's proposal to realize how far they were and see that as a red flag.

The one responsible for that is clearly the project owner who had all the numbers to put next to each others and who should have know that when a price is too low, you investigate it instead of jumping on it.

Peng2, there was a time, not so long ago, that 200 million could buy 20 Sprung boondoggles, or 20 Clarenville size hospitals. Now 200 million is only 3 percent of 6.5 billion!

12.7 billion :some dollar, 200 million , some penny. More of the same from you.

Of course it is good that Nfld companies get work, and it is true that most spent is outside the province. But Cahill was a lapdog waiting for their bone, and 15 million profit is no chicken feed. And if they opposed Muskrat, would they be allowed to get any work on the project? Remember the Rooms?

Those promoting this fiasco has sold out the province, No?

They were rewarded for their promotion and support.

Did they know what they were doing to support MFs? Did they care? I heard too many say they did not care as long as they made a buck……..a buck to them 15 million, a buck to you just 200 million, because just 3 percent. Lies and damn lies!

Think you can balance our budget?

PF

Phil, were you part of Shawmont when the island inventory report was produced? http://www.nlcpr.com/SmallHydro.php

Any idea why it was never readily available? It was very old before it was gifted to the MUN library and seldom talked about.

There is a scanned copy minus the topographic maps of the Shawmont report here: http://www.nlcpr.com/NewfoundlandSmallHydro.pdf with an original copy available at the MUN library (Newfoundland Studies).

Newfoundland and Labrador Hydro commissioned a study in 1986 to conduct an inventory of the potential small hydro resources and found a total of 850 MW in small hydro schemes available on the island that could be connected to the existing power grid. Of this, 172 MW supplied by 22 plants had very good cost/benefit ratios — i.e. they would likely economical. The report was written by SHAWMONT NEWFOUNDLAND LIMITED, the same engineering firm that built the Bay d'Espoir hydroelectric power station.

Grzegorz Prndl

Probably we should bring in

https://www.theverge.com/2017/12/1/16723186/elon-musk-battery-launched-south-australia

That battery stores a total of 129 MWh of energy and can deliver 100MW of power so it could be charged from empty in 90 minutes, or discharged. You wouldn't be fully discharging it either so it is no use (far too small) for averaging out the water flows due to the upper Churchill operations. It would make a nice buffer for more wind generation and also buy time for other generators to ramp up if Holyrood goes down or another other generation asset. I think it would be great for increasing the reliability of the grid.

22:03 Quote: "It would make a nice buffer for more wind generation and also buy time for other generators to ramp up if Holyrood goes down or another other generation asset. I think it would be great for increasing the reliability of the grid."

Precisely its function now in Australia. Musk said it would have

cost his company $50 million had he lost his bet to deliver on time.

Is that you Bruno, now anon?

PF

No not Bruno – just recently started posting. Think I'll add

something to my "anon" profile to lessen all the confusion with

so many anonymous posters.

Tuesday's Budget

http://www.cbc.ca/news/canada/newfoundland-labrador/dwight-ball-steady-as-she-goes-2018-budget-1.4586295

Alberta is balancing its Budget based on speculated revenues from unbuilt pipelines

NS on Pot Revenues, as yet unrealized + Oil price speculation

Ball on "Carbon offsets" from sewage treatment, and Bull Arm deal???

I notice Peng2 made no reply to PF, who challenged him, when he stated 200 million dollars is nothing, as only 3 percent of MF generation asset cost,and goes further to say equal to a penny on a dollar, so 1 percent. Is that the thinking that permitted 100 million waste on the DOME etc that was useless and scrapped? No big deal, penny to the dollar , eh, boy, the ratepayer is good for it. 100 million, a long term care facility…..or the DOME, One a good asset lasting 75 years, the other, no value, a complete waste, instantly scraped

Wish you could drag back that statement, Peng2, or defend it more?

AG

AG and PF:

You both need to reread what I said and not misquote–I never 1x tried to minimize, just put in perspective what was being discussed and to correct a statement by PF that NL companies were major contractors at MF.

As I also said, without knowing how a contractor is paid (ie fixed cost line item under the prime, out of scope TM, direct to owner etc) it becomes a redundant conservation especially when trying to determine cost to a rate payer.

As I said and difficult to understand; try to conceptualize the time required to count to 1B vs 1M – at 1 sec per digit it is 31yrs vs 12days.

I stand by what I said initially – 1-3% is not a major contractor at MF, no matter what the dollar value is; maybe big for NL companies but minor none the less in total scope.

Also, I have never 1x suggested MF was a good idea to start – even back in 2006 when 70% of the NL populace wanted it, so what side of the fence were you on then?

PENG2

Yes, all $ are relative. Glad to see you PENG2 use that comparison, in terms of a millions vs. A billion. Puts things in prospective, at least. After reading this blog for a year or so, I was beginning to see so many $ numbers thrown around, without any relative meaning, that it was among one of my first comments to this blog, was making that comparison with a million vs.a billion. Think ihink it was Maurice, asked my to clarify my comment, which I thanked him for and refined it. I was commenting as annon: or some times as Joe blow, and other times as average Joe, now AJ. Guess the average Joe doesn't have too many million in their personal bank occount. Companies do, and maybe some do now as a tesult of muskrat, because there are a lot of million in a billion, a 1000, and 10 times as many in 10 $ billion. So everything is relative, do hope all those that profited big from muskrat, they deserved every penny others wise hope Leblanc will point it out. Thanks everyone, Joe blow, or AJ.

AJ, you are right to say things are relative, and most all are, but for Peng2 to use that to diminish the value of 10, 15 or a 100 million……..he is playing the statistics game, and you can confuse an argument with numbers. Trump says what a windfall for the AJ by his tax plan, saving of 1000 dollars or 2000 dollars, a lot of money he says. This guy pays 130,000 to shut a woman, and profits 100s of millions by changes to the inheritance avoidance loophole now……..so a game by Peng" like Trump.

That a tradesman works at MFs, and makes double his regular pay say, and the percentage of his cost of MF total being only say 0.0000001 of 1 percent, or some very small figure of the total. Yet I have heard a few tradesmen say they did`t give a F–K about whether this project was good or not, as they profited. More or less take it when you can get it.

Now to say that is meaningless sum as compared to what foreign company made in profit: Not meaningless……it goes right to the core of why this this project proceeded ……too many did not give a F–K……..until the consequences bite them.

JFK said : Ask not what your country can do for you, but what can do for your country. To many of our follow Nflders take the short term view and take what they can get regardless what damage it does to our country and province.

Peng2 can dance and wiggle on his numbers game, but as Ray Guy wrote : when the mosquito spit into the ocean, he said `every bit helps`. So it is with the 1000 dollars or 1 million dollar and 10 million dollars. When dishing out 200 million a day on interest , every dollar counts, or it should.

PF

You covered all the basis there PF, so you left nothing for me to say, except I agree with you. Thanks. AJ.

Hoops…should that be 2 $ million a day or 200$ . I get lost in big numbers, as I mentioned before, they are not in my personal bank account. Lol. AJ.

Yes , 2 million a day, thanks, AJ, an error, least I be accused of playing the numbers game like Peng2, so interest now climbing toward a billion a year , interest to foreigners and bond holders.

PF

PF:

My original statement from above:

——start copy from above——

PF:

I guess you missed that I said contractor inexperience applies only if owner makes a mistake-the owner wholly owns the responsibility for accepting the contractor. Means/methods are the contractors prevue, poor work are the owners responsibility if the owner accepted—so the issues you note need to be separated and analyzed individually.

So we are all on the same page, $127M is 'only' 1% of the $12.7B total cost, so I would again say no NL company was a major contractor at MF—maybe big for Cahill etc, but small in considering the larger scope of the work.

PENG2

——finish copy from above——

Nowhere there did I minimize of try to say anything other than NL companies were not major players at MF. None of the major contracts were let to a NL company-major work was all awards to overseas companies, most probably because the local companies didn't have the bonding capacity to undertake such work.

I also made a $ vs penny comparison-again to put it in relative terms, a comparison most could relate to is like adding a $3000 patio to their newly purchased $300000 home-when looking at the scope of Cahills(assuming ~$150M total contract) work that is effectively what they did, minor in overall scope.

Going forward, please quote correctly-aside from that, MF wasn't my brain child, nor did I let the work. When you reference craft rates, maybe check the RDC agreements posted online-MF craft rates are not 2-3x what unionized craft labour are currently getting when working on other jobs in NL, no matter what 3rd hand rumours you have been told.

PENG2