Written By: “JM”

When

the Muskrat Falls story is fully written, the date July 22, 2013 may be given

prominence as one of those pivotal moments when Nalcor management ought to have

counselled the political leadership to change course on its strategy for

Muskrat Falls.

When

the Muskrat Falls story is fully written, the date July 22, 2013 may be given

prominence as one of those pivotal moments when Nalcor management ought to have

counselled the political leadership to change course on its strategy for

Muskrat Falls.

On

the morning of that day, the Utility and Rates Board of Nova Scotia (UARB)

rejected Emera’s application for approval of the Maritime Link (ML) stating the

deal had to be sweetened by $700 million to $1.4 billion (Net Present Value);

otherwise the construction of the Link would fail as the lowest cost option for

that Province.

the morning of that day, the Utility and Rates Board of Nova Scotia (UARB)

rejected Emera’s application for approval of the Maritime Link (ML) stating the

deal had to be sweetened by $700 million to $1.4 billion (Net Present Value);

otherwise the construction of the Link would fail as the lowest cost option for

that Province.

That same afternoon, the Nalcor CEO was advised that Hydro Quebec (HQ) had filed a declaratory

judgment in the Quebec Superior Court requesting clarification on the

interpretation of the 1969 Power Contract. The contract clauses requiring

interpretation by the courts initially appeared routine, perhaps even innocuous

in nature. However, this challenge

threatens the very foundation of the Muskrat Falls business case.

judgment in the Quebec Superior Court requesting clarification on the

interpretation of the 1969 Power Contract. The contract clauses requiring

interpretation by the courts initially appeared routine, perhaps even innocuous

in nature. However, this challenge

threatens the very foundation of the Muskrat Falls business case.

Nalcor

later surrendered to the entirely predictable demands of the UARB in a revised

offer called the “Energy Access Agreement” (EAA) which committed virtually all

Newfoundland and Labrador’s surplus power to that Province at a price set by

auction in the New England States. This

capitulation by Nalcor secured one of the pre-requisites for the Federal Loan

Guarantee. However, in doing so, Nalcor

precluded the future allocation of firm power and energy from Muskrat Falls from

use for new industrial requirements in Labrador. It also undermined an early argument

used to justify the project.

later surrendered to the entirely predictable demands of the UARB in a revised

offer called the “Energy Access Agreement” (EAA) which committed virtually all

Newfoundland and Labrador’s surplus power to that Province at a price set by

auction in the New England States. This

capitulation by Nalcor secured one of the pre-requisites for the Federal Loan

Guarantee. However, in doing so, Nalcor

precluded the future allocation of firm power and energy from Muskrat Falls from

use for new industrial requirements in Labrador. It also undermined an early argument

used to justify the project.

It

bears stating that Nalcor did not even possess the wherewithal to negotiate a

basement selling price, matching the minimum value the UARB sought in its

analysis of Nova Scotia’s lowest cost option.

It is a critical error; one that will cost NL taxpayers dearly should

New England prices further deflate due to the continued expansion of the US

shale gas industry.

bears stating that Nalcor did not even possess the wherewithal to negotiate a

basement selling price, matching the minimum value the UARB sought in its

analysis of Nova Scotia’s lowest cost option.

It is a critical error; one that will cost NL taxpayers dearly should

New England prices further deflate due to the continued expansion of the US

shale gas industry.

Is

it any wonder that Nova Scotia opposition to the project has been silenced?

it any wonder that Nova Scotia opposition to the project has been silenced?

Such

a convenient and expedient fix was not available to Nalcor to address Hydro

Quebec’s legal action. Instead there remains a legal uncertainty over

the project, as Nalcor continues to spend billions under the waning argument of

the ‘lowest cost alternative’.

a convenient and expedient fix was not available to Nalcor to address Hydro

Quebec’s legal action. Instead there remains a legal uncertainty over

the project, as Nalcor continues to spend billions under the waning argument of

the ‘lowest cost alternative’.

Nalcor

has been coy about the impact of losing the judgment in the

Quebec Superior Court. The Corporation

has publicly argued that the Water Management Agreement is not in jeopardy; that whatever the outcome of the legal challenge , it will have no impact on the Muskrat Falls project.. However, Nalcor has

provided sparse detail to substantiate its claim, conveniently declining to

speak about the specifics of the case while it is before the courts.

has been coy about the impact of losing the judgment in the

Quebec Superior Court. The Corporation

has publicly argued that the Water Management Agreement is not in jeopardy; that whatever the outcome of the legal challenge , it will have no impact on the Muskrat Falls project.. However, Nalcor has

provided sparse detail to substantiate its claim, conveniently declining to

speak about the specifics of the case while it is before the courts.

The

public should not be naive enough to accept Nalcor’s claim. This court challenge of the 1969 Power

Contract is very relevant to the Muskrat Falls business case. The terse response from Premier Dunderdale on the day news of the court

challenge broke perhaps reflected the true uncensored opinion of Nalcor’s leadership

in response to Hydro Quebec’s initiative.

It was Dunderdale in full nationalist form, the magnitude of this threat

to the ‘plan’ was demonstrable by her frustration.

public should not be naive enough to accept Nalcor’s claim. This court challenge of the 1969 Power

Contract is very relevant to the Muskrat Falls business case. The terse response from Premier Dunderdale on the day news of the court

challenge broke perhaps reflected the true uncensored opinion of Nalcor’s leadership

in response to Hydro Quebec’s initiative.

It was Dunderdale in full nationalist form, the magnitude of this threat

to the ‘plan’ was demonstrable by her frustration.

Make

no doubt this court case will have an impact on Nalcor’s overall business plan

and energy marketing strategy. It is a

big deal which was duly acknowledged within Nalcor’s 2014 Strategy document:

no doubt this court case will have an impact on Nalcor’s overall business plan

and energy marketing strategy. It is a

big deal which was duly acknowledged within Nalcor’s 2014 Strategy document:

Stripped

to its essence, the challenge is one in which Hydro Quebec seeks judicial

clarification that CFLCo cannot take more than 300 MW from the Upper Churchill

facility for sale to any third party, pursuant to the recapture provisions of

the 1969 Power Contract. If upheld, it will limit Nalcor’s current practice of

temporarily “storing” the remaining RECALL energy in the reservoir, producing

the energy when prices are highest in the US market.

to its essence, the challenge is one in which Hydro Quebec seeks judicial

clarification that CFLCo cannot take more than 300 MW from the Upper Churchill

facility for sale to any third party, pursuant to the recapture provisions of

the 1969 Power Contract. If upheld, it will limit Nalcor’s current practice of

temporarily “storing” the remaining RECALL energy in the reservoir, producing

the energy when prices are highest in the US market.

More

importantly to the NL ratepayer, an unwelcome judicial outcome may also be

interpreted in a manner such that CFLCo cannot produce ‘stored energy’ for

Nalcor under the terms of the Water Management Agreement beyond the 300 MW

limit. The reader should note that CFLCo is owned by

both Nalcor and Hydro Quebec. In a legal

context, Nalcor and its other subsidiaries are defined as “third parties” under

the application of the 1969 Power Contract.

importantly to the NL ratepayer, an unwelcome judicial outcome may also be

interpreted in a manner such that CFLCo cannot produce ‘stored energy’ for

Nalcor under the terms of the Water Management Agreement beyond the 300 MW

limit. The reader should note that CFLCo is owned by

both Nalcor and Hydro Quebec. In a legal

context, Nalcor and its other subsidiaries are defined as “third parties” under

the application of the 1969 Power Contract.

Stated

another way, any limit on ‘stored energy production’ would gut the

effectiveness of the Water Management Agreement. It would eliminate the very tool Nalcor must

have, in order to meet its firm capacity commitments to the Island, industrial

customers, and to Nova Scotia. It would potentially jeopardize the reliability

of the electrical system post-commissioning of the interconnection to Labrador.

Ultimately, it would result in higher costs to rate payers.

another way, any limit on ‘stored energy production’ would gut the

effectiveness of the Water Management Agreement. It would eliminate the very tool Nalcor must

have, in order to meet its firm capacity commitments to the Island, industrial

customers, and to Nova Scotia. It would potentially jeopardize the reliability

of the electrical system post-commissioning of the interconnection to Labrador.

Ultimately, it would result in higher costs to rate payers.

In

the absence of any substantive analysis by Nalcor, the remainder of this post

will attempt to explain the risk of an unfavourable ruling from the Quebec

Superior Court:

the absence of any substantive analysis by Nalcor, the remainder of this post

will attempt to explain the risk of an unfavourable ruling from the Quebec

Superior Court:

1. Muskrat Falls is what is commonly

described a “Run of the River” hydroelectric facility. The Muskrat Falls reservoir has a live

storage capacity of 50 million cubic meters; the figure represents 0.2% the

size of the Upper Churchill reservoir. The

limited ability to store water means Muskrat must produce energy when the water

runs. When flows are less than optimal, production

is dependent upon the water flows released from the facility upstream.

described a “Run of the River” hydroelectric facility. The Muskrat Falls reservoir has a live

storage capacity of 50 million cubic meters; the figure represents 0.2% the

size of the Upper Churchill reservoir. The

limited ability to store water means Muskrat must produce energy when the water

runs. When flows are less than optimal, production

is dependent upon the water flows released from the facility upstream.

2. In 2009, Nalcor submitted a Water Management

Agreement (WMA) to the Public Utilities Board (PUB) for approval. The WMA is intended to optimize production

from both Upper Churchill and Muskrat facilities on a year round basis. Both plants need to be used in combination in

order that the Labrador Island Link can provide 900 MW on an “as required”

basis for extended periods of time.

Agreement (WMA) to the Public Utilities Board (PUB) for approval. The WMA is intended to optimize production

from both Upper Churchill and Muskrat facilities on a year round basis. Both plants need to be used in combination in

order that the Labrador Island Link can provide 900 MW on an “as required”

basis for extended periods of time.

In simplest terms: when

the water flows at Muskrat Falls are high, and the Nalcor demand for energy is

low, the surplus generation is used to meet CFLCo’s obligations to Hydro

Quebec. The water flow at the Upper

Churchill is reduced accordingly. Any

energy produced by Muskrat Falls to meet the CFLCo delivery is “banked” as

water stored within the Upper Churchill reservoir.

the water flows at Muskrat Falls are high, and the Nalcor demand for energy is

low, the surplus generation is used to meet CFLCo’s obligations to Hydro

Quebec. The water flow at the Upper

Churchill is reduced accordingly. Any

energy produced by Muskrat Falls to meet the CFLCo delivery is “banked” as

water stored within the Upper Churchill reservoir.

Alternatively, when the flow at the

Muskrat Falls plant is insufficient to meet Nalcor’s demand, the Upper

Churchill plant production is increased.

The production will draw down the “banked” energy.

Muskrat Falls plant is insufficient to meet Nalcor’s demand, the Upper

Churchill plant production is increased.

The production will draw down the “banked” energy.

Assuming that the extra production

from the Upper Churchill is assured under the mechanism of the WMA, Nalcor can

guarantee that 824 MW will be produced to meet the rated nameplate capacity of

the Muskrat Falls plant. In combination

with the remaining 80 MW of RECALL power in winter 900 MW is available for

transmission over the Labrador Island Link.

It is fairly simple to manage the water flows in this fashion and

although it is integral to Nalcor’s planning, following the commissioning of

Muskrat Falls, CFLco’s ability to implement the plan is being legally

challenged. The Quebec Superior Court

may declare it contrary to the intent of the 1969 Power Contract.

from the Upper Churchill is assured under the mechanism of the WMA, Nalcor can

guarantee that 824 MW will be produced to meet the rated nameplate capacity of

the Muskrat Falls plant. In combination

with the remaining 80 MW of RECALL power in winter 900 MW is available for

transmission over the Labrador Island Link.

It is fairly simple to manage the water flows in this fashion and

although it is integral to Nalcor’s planning, following the commissioning of

Muskrat Falls, CFLco’s ability to implement the plan is being legally

challenged. The Quebec Superior Court

may declare it contrary to the intent of the 1969 Power Contract.

3. Without the Water

Management Agreement there may be times when production from the Muskrat Falls

plant is minimal. If output from the Upper

Churchill plant is at the lowest contractual limit of 1200 MW, the resulting

production from Muskrat Falls from the water flow would be less than 200MW[i].

Management Agreement there may be times when production from the Muskrat Falls

plant is minimal. If output from the Upper

Churchill plant is at the lowest contractual limit of 1200 MW, the resulting

production from Muskrat Falls from the water flow would be less than 200MW[i].

4. Based upon the example in

part 3, above, over 700 MW of additional power may be needed from the Upper

Churchill facility under the WMA to provide an equivalent production of 900 MW

to be delivered to the Labrador Island Link.

part 3, above, over 700 MW of additional power may be needed from the Upper

Churchill facility under the WMA to provide an equivalent production of 900 MW

to be delivered to the Labrador Island Link.

5. The WMA respects the terms

of previous power contracts. Previous

contracts such as the 1969 Power Contract, and the GWAC take precedence.

of previous power contracts. Previous

contracts such as the 1969 Power Contract, and the GWAC take precedence.

6. The 1969 Power Contract

between CFLCo and Hydro Quebec has language limiting the maximum amount of

Power which can be recalled by CFLCo to sell to third parties. This quantity is withheld from “the power and

energy agreed to be sold”.

between CFLCo and Hydro Quebec has language limiting the maximum amount of

Power which can be recalled by CFLCo to sell to third parties. This quantity is withheld from “the power and

energy agreed to be sold”.

7. Of the 300 MW of recall

power there is approximately 80 MW of remaining capacity in winter when all

domestic requirements are met in Labrador.

power there is approximately 80 MW of remaining capacity in winter when all

domestic requirements are met in Labrador.

8. Under the Administration

of Premier Frank Moores, an attempt was made to increase the recall provision from

300 MW to 800 MW under the terms of the 1961 lease agreement. The attempt failed in both the Newfoundland

and Quebec Courts. A subsequent Appeal

to the Supreme Court of Canada (SCOC), upheld those decisions; maximum recall

from the Upper Churchill Facility remained at 300MW.

of Premier Frank Moores, an attempt was made to increase the recall provision from

300 MW to 800 MW under the terms of the 1961 lease agreement. The attempt failed in both the Newfoundland

and Quebec Courts. A subsequent Appeal

to the Supreme Court of Canada (SCOC), upheld those decisions; maximum recall

from the Upper Churchill Facility remained at 300MW.

Given the Court Decision described in

Part 8, it may be apparent why the SCOC Decision on the interpretation of the

1969 Power Contract is so important. If

CFLCo cannot sell more than 300 MW to a third party, it means in periods of low

water flow at Muskrat Falls, only 80 MW of available RECALL power is available

to be added to meet Island demand.

Part 8, it may be apparent why the SCOC Decision on the interpretation of the

1969 Power Contract is so important. If

CFLCo cannot sell more than 300 MW to a third party, it means in periods of low

water flow at Muskrat Falls, only 80 MW of available RECALL power is available

to be added to meet Island demand.

If the Quebec Courts uphold this

extreme interpretation of the 1969 contract there could be extended periods

where the power available over the Labrador Island Link is ~280 MW, and not the

900 MW which has been assumed by Nalcor. Although it would not materially impact the

total amount of energy produced each year by Muskrat Falls, the energy may not

be available when we need it!

extreme interpretation of the 1969 contract there could be extended periods

where the power available over the Labrador Island Link is ~280 MW, and not the

900 MW which has been assumed by Nalcor. Although it would not materially impact the

total amount of energy produced each year by Muskrat Falls, the energy may not

be available when we need it!

What are the impacts of such an

outcome? They are considerable:

outcome? They are considerable:

1. Nalcor must still meet the

contractual requirement of 167 MW to Emera as part of the Nova Scotia Block.

contractual requirement of 167 MW to Emera as part of the Nova Scotia Block.

2. The Muskrat Falls Power Purchase

Agreement (PPA) stipulates that the available capacity (in MW) is limited, firstly, by

the contractual obligation to Nova Scotia and, secondly, by the terms of the Water

Management Agreement. Put succinctly, if

the Courts uphold Quebec’s legal challenge, the Muskrat Falls PPA guarantees only 110 MW of firm dispatchable power out of the

nameplate capacity of 824 MW. This

excerpt from the Muskrat Falls PPA applies:

Agreement (PPA) stipulates that the available capacity (in MW) is limited, firstly, by

the contractual obligation to Nova Scotia and, secondly, by the terms of the Water

Management Agreement. Put succinctly, if

the Courts uphold Quebec’s legal challenge, the Muskrat Falls PPA guarantees only 110 MW of firm dispatchable power out of the

nameplate capacity of 824 MW. This

excerpt from the Muskrat Falls PPA applies:

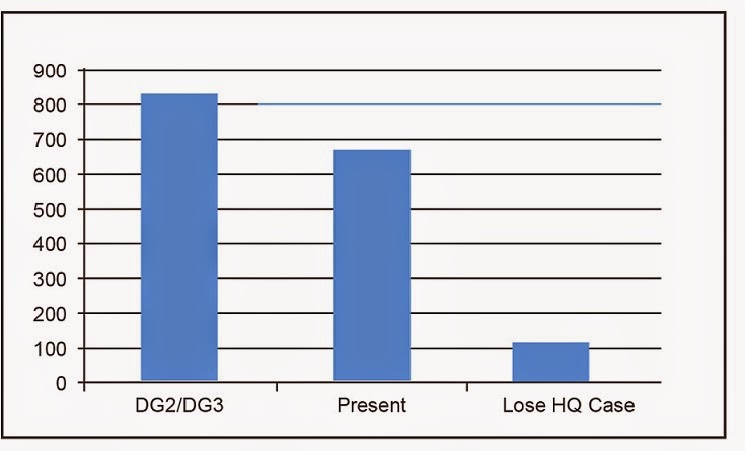

3. 110 MW is clearly far less

than the 675 MW, recently quoted by Nalcor, as reliable firm capacity from the

Labrador Island Link at Soldiers Pond. In

the context of issues raised in Part I of this Series, that amount of power is less

than 15% of the firm capacity, assumed by Nalcor, in the lowest cost analysis

used at DG2/DG3 decision gates.

than the 675 MW, recently quoted by Nalcor, as reliable firm capacity from the

Labrador Island Link at Soldiers Pond. In

the context of issues raised in Part I of this Series, that amount of power is less

than 15% of the firm capacity, assumed by Nalcor, in the lowest cost analysis

used at DG2/DG3 decision gates.

4. If the firm generation is

not guaranteed from Labrador, additional generation capacity will be needed on

the island to meet the required reliability targets. The most obvious option would be the continued

and long term dependence upon the Holyrood thermal station. If Nalcor implements the upgrades which are

assumed a requirement for the isolated option case, $600 million of CAPEX is required

to maintain Holyrood as a long term source of capacity.

not guaranteed from Labrador, additional generation capacity will be needed on

the island to meet the required reliability targets. The most obvious option would be the continued

and long term dependence upon the Holyrood thermal station. If Nalcor implements the upgrades which are

assumed a requirement for the isolated option case, $600 million of CAPEX is required

to maintain Holyrood as a long term source of capacity.

5. Pursuant to the 1969 Power

Contract, Hydro Quebec may elect to take all its allocated energy, per month,

in the first or last 20 days. This implies

there is a potential for minimal water flow for up to 10 days duration. Not only is there potential for Holyrood to be

needed as back up generation, it may be required for prolonged periods to meet

base deliveries. The resulting fuel

charges would be larger than those assumed by Nalcor, in its lowest cost

analysis, and completed as part of DG2 and DG3.

The incremental fuel costs would be much higher than any offsetting

energy exports, resulting in net negative impact to domestic rates.

Contract, Hydro Quebec may elect to take all its allocated energy, per month,

in the first or last 20 days. This implies

there is a potential for minimal water flow for up to 10 days duration. Not only is there potential for Holyrood to be

needed as back up generation, it may be required for prolonged periods to meet

base deliveries. The resulting fuel

charges would be larger than those assumed by Nalcor, in its lowest cost

analysis, and completed as part of DG2 and DG3.

The incremental fuel costs would be much higher than any offsetting

energy exports, resulting in net negative impact to domestic rates.

These

questions are now being asked by Interveners within the ongoing PUB

investigation into the reliability of the Island’s electrical system. True to form, Nalcor has attempted to limit the PUB from examining these critical issues. It deems this legal risk outside

the scope of Phase II of the investigation dealing with issues relating to

security of supply after Muskrat is commissioned.

questions are now being asked by Interveners within the ongoing PUB

investigation into the reliability of the Island’s electrical system. True to form, Nalcor has attempted to limit the PUB from examining these critical issues. It deems this legal risk outside

the scope of Phase II of the investigation dealing with issues relating to

security of supply after Muskrat is commissioned.

I am hopeful this Post will document

why Nalcor’s position is completely without merit.

why Nalcor’s position is completely without merit.

Despite Nalcor’s attempt to thwart

review of the WMA, the PUB would be negligent to not include this legal risk as

part of its ongoing investigation. The

interpretation of the 1969 Power Contract is an essential element to

understanding the reliability of our generation system post-Muskrat Falls. These issues cannot be decoupled or examined

on a selective basis. Although the interpretation presented in this paper is

severe it is, in the opinion of the Author, one of the possible outcomes.

review of the WMA, the PUB would be negligent to not include this legal risk as

part of its ongoing investigation. The

interpretation of the 1969 Power Contract is an essential element to

understanding the reliability of our generation system post-Muskrat Falls. These issues cannot be decoupled or examined

on a selective basis. Although the interpretation presented in this paper is

severe it is, in the opinion of the Author, one of the possible outcomes.

Nalcor must be challenged to explain to the PUB the implications of a Court Decision that

sides with

Hydro-Quebec. While one must respect

that the issue is currently before the

Hydro-Quebec. While one must respect

that the issue is currently before the

Quebec Superior Court, the PUB assessment

need not be public but it must be completed.

need not be public but it must be completed.

As stated by the Electrical Power Control Act this is clearly within the

responsibility of the

responsibility of the

PUB to guarantee adequate planning of the

provinces electrical supply.

provinces electrical supply.

Failure of the PUB to permit the Grand

River Keepers and Danny Dumeresque to ask questions relating to the Water

Management Agreement would not only be a failure of public transparency. It would constitute a failure of the PUB, itself,

to fulfil its legislated responsibility.

Indeed, why have a regulatory body if issues of this public importance

and interest are not fully investigated?

River Keepers and Danny Dumeresque to ask questions relating to the Water

Management Agreement would not only be a failure of public transparency. It would constitute a failure of the PUB, itself,

to fulfil its legislated responsibility.

Indeed, why have a regulatory body if issues of this public importance

and interest are not fully investigated?

Part I of this series describes the

false inputs which Nalcor used in its DG2 Reference to the PUB and third party

reviews by Navigant and MHI. The author

would describe it as strategic. My old

friend, Uncle Gnarley, would more likely describe it as deception.

false inputs which Nalcor used in its DG2 Reference to the PUB and third party

reviews by Navigant and MHI. The author

would describe it as strategic. My old

friend, Uncle Gnarley, would more likely describe it as deception.

When the risks associated with the

failure of the Water Management Agreement are considered, it is not difficult

to see the Nalcor decision to proceed without legal certainty was perhaps delusional.

failure of the Water Management Agreement are considered, it is not difficult

to see the Nalcor decision to proceed without legal certainty was perhaps delusional.

“Deception and Delusion” is a concept

familiar to those who have read the the recent Oxford Paper by Ansar and Flyvbjerg, et al. The next and final part of this series will

draw a parallel between the conclusions in this research, and what has unfolded

on the Lower Churchill project. I would

encourage readers who are interested to spend the 10$ to download the

Oxford paper. It is well worth the

read.

familiar to those who have read the the recent Oxford Paper by Ansar and Flyvbjerg, et al. The next and final part of this series will

draw a parallel between the conclusions in this research, and what has unfolded

on the Lower Churchill project. I would

encourage readers who are interested to spend the 10$ to download the

Oxford paper. It is well worth the

read.

[i] The reader can find further clarification on this from the 2009

application to the Public Utilities Board.

Section 3.1 of the prefilled evidence explains the various extreme

situations on how the Gull Island reservoir would respond depending upon the

delivery of water from the Upper Churchill.

Within this pre-filled evidence Nalcor concluded that without the WMA

there would only be 400 MW of firm output from the Gull Island facility from a

rated nameplate of 2250 MW. Using a

similar analogy the firm production from Muskrat Falls would be less than 200

MW in periods of low water flow.

_________________________________

application to the Public Utilities Board.

Section 3.1 of the prefilled evidence explains the various extreme

situations on how the Gull Island reservoir would respond depending upon the

delivery of water from the Upper Churchill.

Within this pre-filled evidence Nalcor concluded that without the WMA

there would only be 400 MW of firm output from the Gull Island facility from a

rated nameplate of 2250 MW. Using a

similar analogy the firm production from Muskrat Falls would be less than 200

MW in periods of low water flow.

_________________________________

Editor’s Note:

VISION BUILT ON DELUSION (Part II) was written by “JM”. He is the

anonymous researcher and writer who presented a major Paper to the PUB Review

during the Muskrat Falls Review. JM has

written a number for Uncle Gnarley Blog, including, most recently, The Snow Job (Part I). Others include: Gnarley’s Theory of Political Devolution and The Great Revolutionary From The Shore and The Right Side of History.

anonymous researcher and writer who presented a major Paper to the PUB Review

during the Muskrat Falls Review. JM has

written a number for Uncle Gnarley Blog, including, most recently, The Snow Job (Part I). Others include: Gnarley’s Theory of Political Devolution and The Great Revolutionary From The Shore and The Right Side of History.

JM has also submitted to the

PUB a Paper entitled: Underestimating Peak Load and The Potential Impact On The Muskrat Falls Solution.

PUB a Paper entitled: Underestimating Peak Load and The Potential Impact On The Muskrat Falls Solution.

A full list of JM’s Papers can be found on the The Sir Robert Bond Papers Blog by Ed Hollett

To readers who may

be unfamiliar with “JM”, I would say that, while circumstances

require his anonymity, you will be impressed with the depth of his analysis on

many aspects of the Muskrat Falls Project.

be unfamiliar with “JM”, I would say that, while circumstances

require his anonymity, you will be impressed with the depth of his analysis on

many aspects of the Muskrat Falls Project.

– Des Sullivan

Much appreciation to JM for contributing yet another awesome piece of analysis, and to Uncle G for making this work available.

My only question to JM relates to his contention that should HQ's view of the 1969 power contract prevail, this legal outcome would not materially impact the total amount of energy produced each year by Muskrat Falls.

I am concerned that should HQ's view of the 1969 contract prevail, the result would be that the annual output of Muskrat Madness would be very significantly reduce. Here is why:

Nalcor's water flow analysis shows that Muskrat Madness will only have sufficient water flow in normal years to reach its nameplate production rate for something like 2 months per year. This peak production will of course be during the spring freshet. At this time of year, Nalcor experiences low demand and high in-flows on the island and as a result already routinely spills water on the island. The upshot of this is that in years of normal water flow there will be little or no spring storage capacity available on the island. The transmission link with Nova Scotia is limited to 500 MW. If Nalcor can't go ahead with its scheme to store excess spring production at Upper Churchill and use a large block of UC winter production capacity now relied upon by HQ, Nalcor will have no physical alternative than to spill water somewhere in its integrated system. Nalcor could play silly games like dumping this excess water on the island so it can claim that all of Muskrat Madness's production is being used, but this doesn't change the outcome for NL consumers.

My contention is that should HQ's litigation go against Nalcor, a large portion of the annual potential generation of Muskrat Madness will be spilled. What am I missing?

Tom… Nalcor have generated predictions of the annual firm energy from Muskrat Falls with and without the WMA. They are within 5%. I take these to be true. You are right however, that there may be periods (in May) where Muskrat will be at high production due to the Spring Freshet. There may be spills due to inability to sell the power. I do not think this is a risk. the risk is that it will be sold for a very small price due to the time of the year. Then when we need to buy power it will be much more expensive, because it is in January and February.