On July 12, 2014 the CEO of Nalcor wrote a

Letter to the Editor which was entitled “Muskrat Falls Remains the Best

Option”. Its intent was clearly to counter

some of the recent discussion about the final costs of electricity within the

province. Unfortunately, it did little to

remedy my concerns about where electricity rates in the province are heading.

Letter to the Editor which was entitled “Muskrat Falls Remains the Best

Option”. Its intent was clearly to counter

some of the recent discussion about the final costs of electricity within the

province. Unfortunately, it did little to

remedy my concerns about where electricity rates in the province are heading.

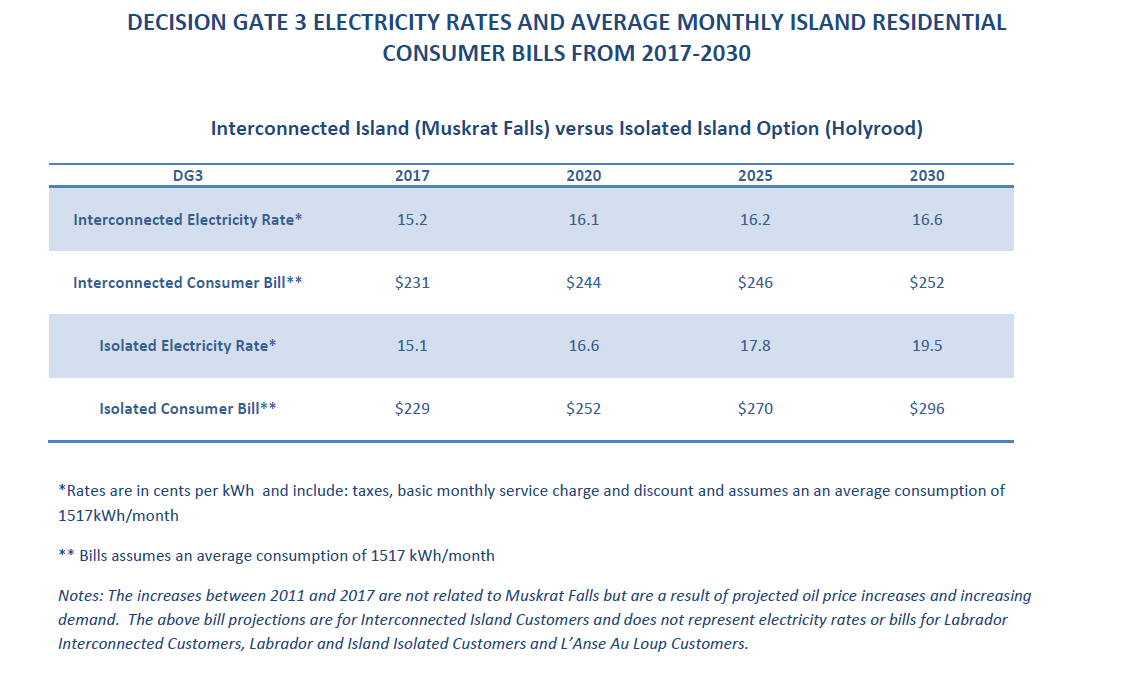

We should begin with a simple clarification. Nalcor CEO, Ed Martin quoted that:

“In 2018, electricity rates for households on the island are

projected to be 16.4 cents per kilowatt hour (kWh), which is about $249 for an

average monthly bill, approximately half a cent higher than the rate estimated

at sanction of the Muskrat Falls project (15.9 cents/kWh)”.

projected to be 16.4 cents per kilowatt hour (kWh), which is about $249 for an

average monthly bill, approximately half a cent higher than the rate estimated

at sanction of the Muskrat Falls project (15.9 cents/kWh)”.

Unfortunately, Mr. Martin is not correct.

At project sanction the rates projected by Nalcor was 15.2 cents/kwhr.

Therefore, the

increase from project sanction is 15.2 to 16.4 cents per kwhr, or about 7.8%. This is not a major discrepancy, but

unfortunately it continues to undermine Nalcor’s credibility when it comes to

rate projections.

increase from project sanction is 15.2 to 16.4 cents per kwhr, or about 7.8%. This is not a major discrepancy, but

unfortunately it continues to undermine Nalcor’s credibility when it comes to

rate projections.

The next

sentence in the letter contains the following:

sentence in the letter contains the following:

“Looking out to 2020, electricity rates will be around

17.3 cents/kWh or about $262 for an average monthly bill. This includes

anticipated rate increases with Muskrat Falls in service and all planned

capital projects by Hydro on the island”

17.3 cents/kWh or about $262 for an average monthly bill. This includes

anticipated rate increases with Muskrat Falls in service and all planned

capital projects by Hydro on the island”

This statement provided slight comfort as

it confirmed that the cost for the third line to the Avalon was correctly

included in the projections at project sanction[1]. However, we ought to ask: does the phrase “on

the island” imply that the planned third line to Labrador West is not included

in these rate projections?

it confirmed that the cost for the third line to the Avalon was correctly

included in the projections at project sanction[1]. However, we ought to ask: does the phrase “on

the island” imply that the planned third line to Labrador West is not included

in these rate projections?

Nalcor continue to obfuscate the discussion

about rates by not providing clear language within these public releases. Why, I wonder, can they not simply release

to the public a detailed assessment of how the rates are calculated?

about rates by not providing clear language within these public releases. Why, I wonder, can they not simply release

to the public a detailed assessment of how the rates are calculated?

All Nalcor need do is release a basic excel

file detailing the items what items are included in the calculation, and their cost. This information would be of enormous

assistance to interested parties. It will

eventually be released to the PUB, so why not now?

file detailing the items what items are included in the calculation, and their cost. This information would be of enormous

assistance to interested parties. It will

eventually be released to the PUB, so why not now?

The very next sentence within the release

was perhaps the most disconcerting:

was perhaps the most disconcerting:

“When Muskrat Falls is fully operational and our province is powered

almost exclusively by renewable energy sources, rates will stabilize for

customers, increasing on average around one to two per cent per year”

almost exclusively by renewable energy sources, rates will stabilize for

customers, increasing on average around one to two per cent per year”

To the casual reader the statement may seem

innocent, almost comforting. However, it

represents a major departure from the original plan. Part of the argument for Muskrat Falls was

that rates would stabilize over time.

Following the initial rate shock, prices would effectively stay the same. With the passage of time, inflation would

ensure that the real cost of electricity would decrease.

innocent, almost comforting. However, it

represents a major departure from the original plan. Part of the argument for Muskrat Falls was

that rates would stabilize over time.

Following the initial rate shock, prices would effectively stay the same. With the passage of time, inflation would

ensure that the real cost of electricity would decrease.

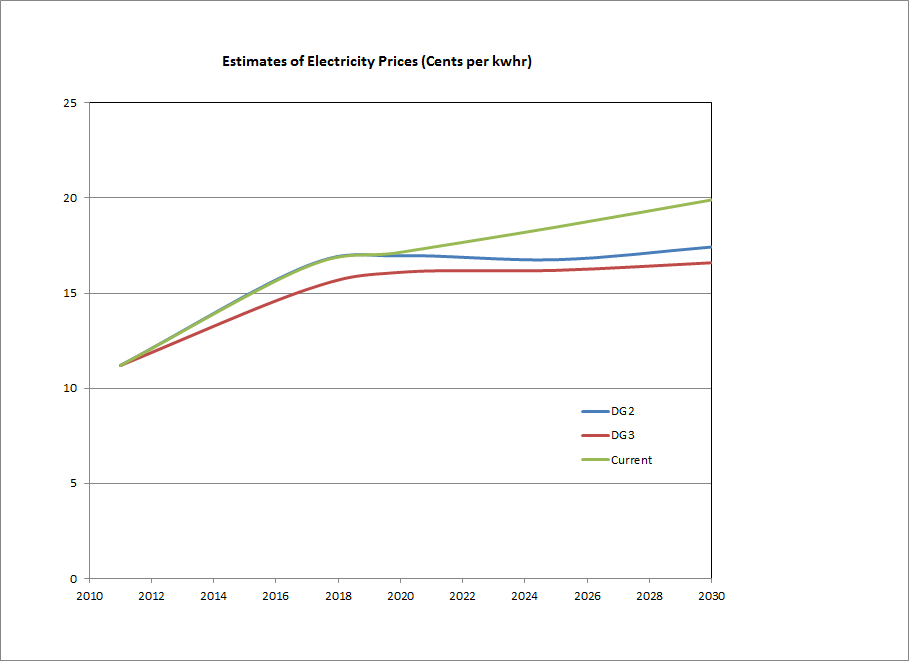

As far as the Author is concerned, this was the only real reason

to proceed with Muskrat Falls. Over

time, the unit rates would decrease in real dollars. Now Nalcor are projecting that following the

initial 46% increase in electricity rates (2011 to 2017)[2]

rates will continue to increase 1-2% each and every year! This is best communicated graphically[3]:

to proceed with Muskrat Falls. Over

time, the unit rates would decrease in real dollars. Now Nalcor are projecting that following the

initial 46% increase in electricity rates (2011 to 2017)[2]

rates will continue to increase 1-2% each and every year! This is best communicated graphically[3]:

Nalcor should be challenged to immediately

verify this statement regarding rate projection. If true, it

reflects a major departure to the rationale for the project. Indeed again, if true, it

suggests the online rate calculator, provided at DG3, was incorrect and

misrepresented the benefits of the project.

Likely, it implies that the Power Purchase Agreement (PPA) has been

adjusted to further backload the cost recovery of the Muskrat Falls project.

verify this statement regarding rate projection. If true, it

reflects a major departure to the rationale for the project. Indeed again, if true, it

suggests the online rate calculator, provided at DG3, was incorrect and

misrepresented the benefits of the project.

Likely, it implies that the Power Purchase Agreement (PPA) has been

adjusted to further backload the cost recovery of the Muskrat Falls project.

Nalcor has never had a consistent message

when it comes to the pricing of the Muskrat Falls project. Since the DG2 decision they have refused to provide

the public details about the stand alone cost of Muskrat power delivered to the

Avalon Peninsula.

when it comes to the pricing of the Muskrat Falls project. Since the DG2 decision they have refused to provide

the public details about the stand alone cost of Muskrat power delivered to the

Avalon Peninsula.

Nalcor need to clear the air, share the

numbers, and let people have transparency.

Nalcor need only to look to their partner for such guidance. Emera’s submission to the UARB is a benchmark in public disclosure, and education.

numbers, and let people have transparency.

Nalcor need only to look to their partner for such guidance. Emera’s submission to the UARB is a benchmark in public disclosure, and education.

Nalcor need also to provide visibility on

the additional sensitivities which will potentially have a further, dramatic

impact on the rate projections. These sensitivities were assessed by the Author in Volume 11 of the discussion paper series and are again provided to the reader:

the additional sensitivities which will potentially have a further, dramatic

impact on the rate projections. These sensitivities were assessed by the Author in Volume 11 of the discussion paper series and are again provided to the reader:

* Hydro Quebec are successful in

their declaratory judgement regarding the

their declaratory judgement regarding the

interpretation of the 1969 Power

Contract.

Contract.

* Third line to Labrador West

which government has advised will be partially recovered

which government has advised will be partially recovered

by the island

ratepayer

ratepayer

* Vale and other industrial

customers are provided energy at a lower, subsidized rate.

customers are provided energy at a lower, subsidized rate.

* There is a 5% reduction in the

amount of energy used, due to the massive increase in

amount of energy used, due to the massive increase in

the price of energy in

the province. Price will impact demand.

the province. Price will impact demand.

Nalcor’s strategy, to date, has been to

becloud the issue of what this project will ultimately cost, and the nature of the

real risks to the Island ratepayer. The

public should not accept such a situation.

becloud the issue of what this project will ultimately cost, and the nature of the

real risks to the Island ratepayer. The

public should not accept such a situation.

Given the size of the expenditure and

Nalcor’s behaviour, it is not difficult to see why Muskrat needs greater public

oversight. Indeed, Nalcor’s abysmal record

of meeting project estimates should demand it.

Nalcor’s behaviour, it is not difficult to see why Muskrat needs greater public

oversight. Indeed, Nalcor’s abysmal record

of meeting project estimates should demand it.

[1] If the reader references Figure 4 of Volume 11 of the JM discussion paper series “Consumer Electricity Prices From Muskrat Falls” there is a slight peak on the “existing asset cost” from 2012 to 2016. Can it be assumed that this is the cost associated with the third line?

[2] Rates are 11.2 cents per kwhr in 2011.

[3] The sources of information are: DG2 data is from PUB-Nalcor-5 provided on the PUB website; DG3 data is provided from the table referenced above; Current projections is based on the July 11 letter to the editor.

———————————————————————–

(Editor’s Note: JM is the anonymous author of a 175 page Submission to the Public Utilities Board (PUB) entitled:Muskrat Falls – The Benefits of a Phased Development. He has also written Labrador Mining – A Reason to Rethink and Upper Churchill – The Unexplored Alternative. He has written several Posts for Uncle Gnarley Blog. His latest Paper, Consumer Electricity Prices From Muskrat Falls, is in my view, the best analysis available as to the impact on residential electrical rates of the latest overruns at Muskrat Falls, additional transmission lines and an additional 100 MW generator at Holyrood.)

"Nalcor continue to obfuscate the discussion about rates by not providing clear language within these public releases. Why, I wonder, can they not simply release to the public a detailed assessment of how the rates are calculated? "

I can not believe that in a project which is 100% funded by the people of the province that this request needs to be made. The political systems should not allow such a massive public expenditure, without this information being made public. Why is the leader of the opposition not making this very same demand?

This is an excellent post

Martin says the rate of 17.3 cents for 2020 includes all planned capital projects for the island. The most recent is the third line to Western Avalon at 297 million. Yet that application says further line upgrades are needed soon, and applications to the PUB will follow. Some wood pole 230 kw lines are near their end of life. One of the two lines coming east from Western Avalon will overload if one line goes down and both lines together have a capacity of only 518 MW. This means blackouts if the Muskrat Falls bipole line is down, since the 465MW from Holyrood will not be available, once decommissioned. In that situation, the eastern Avalon can only get half of the power needed here from our 230 kv island lines. The third line as far as Western Avalon helps Vale Inco and the refinery, but makes no provision east of there. Does Martins figures allow for the additional line upgrades, and a third line east of Western Avalon I wonder. Somehow I doubt it.

As a slightly informed, and younger taxpayer, this is one of only dozens of issues I have with this project. It seems that most of the people that are for this project are older, knowing they will never be alive to really worry about the price increases. And the more I read the more annoyed and peeved I get.